Banking

Banking software solutions

Modernize your bank’s information management systems with powerful content and process management solutions.

Operational Efficiency and Customer Service

OnBase enhances operational efficiency in banks and credit unions by automating document management, workflow processes, and payment processing, reducing turnaround times and errors. It also improves customer service by providing quick access to customer records and efficiently managing service requests, leading to higher customer satisfaction.

Document Management

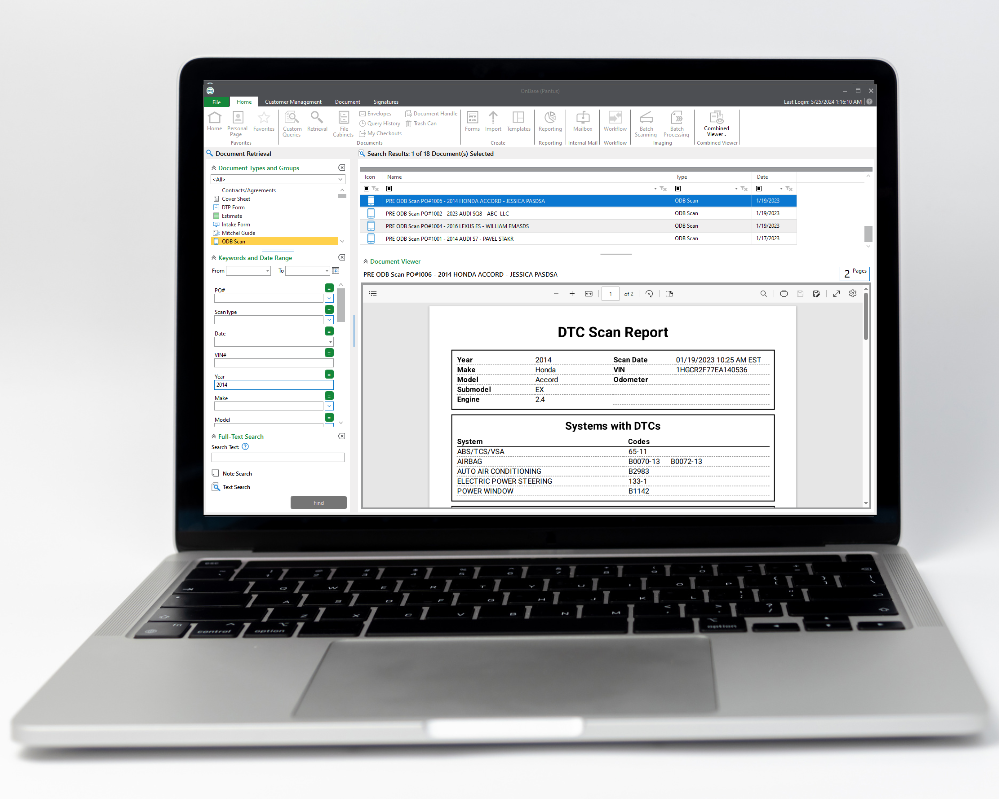

- Centralized Repository: OnBase acts as a single repository for all documents and Cold Reports, reducing the reliance on paper and ensuring that documents are easily accessible.

- Document Retrieval: Staff can quickly retrieve documents using keyword searches, which improves response times

Workflow Automation

- Account Opening: Streamlines the account opening process by automating document collection, verification, and approval steps.

- Loan Processing: Automates the loan application process, from application submission to underwriting and approval, reducing turnaround times.

- E-Signatures: Supports electronic signatures for faster and more secure document signing.

Finance

- Accounts Payable Invoice Processing: Automates the capture, approval, routing and payment of invoices, reducing processing time and errors.

- Centralized Repository to store reconciliation reports and other financial reports

Customer Service

- Customer Records: Provides a unified view of customer information, allowing staff to quickly access account details, transaction histories, and related documents.

- Case Management: Manages customer service requests and inquiries efficiently, tracking progress and ensuring timely resolution.

Compliance, Risk Management, and Security

Compliance and Risk Management

- Regulatory Compliance: Helps ensure compliance with industry regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) by automating documentation and reporting processes.

- Audit Trails: Maintains detailed audit trails for all document activities, aiding in compliance audits and risk management.

Disaster Recovery and Business Continuity

- Data Backup: Ensures that critical documents are backed up and can be quickly restored in case of a disaster.

- Business Continuity: Supports business continuity plans by ensuring that essential documents are accessible from remote locations.

Fraud Detection and Prevention

- Document Verification: Automates the verification of documents to detect fraudulent activities.

- Alerts and Notifications: Sends alerts and notifications for suspicious activities, enabling timely intervention.

HR Management

- Employee Records: Manages employee documents, including onboarding, performance reviews, and compliance training records.

- Recruitment: Automates the recruitment process by managing job applications, resumes, and interview documentation.